Manage Personal Medical Costs With GnuCash

Updated on 2021-08-25

In early 2017, I experienced a recurrence of lumbar (lower) spine issues. Toward the latter part of 2017, I also began experiencing pain in the thoracic (middle) area of my spine. After doing some research about spine issues, I determined that I needed to see someone before my issues became worse and as a result, possibly became permanently debilitating.

I saw a number of medical providers for diagnosis, imaging, and procedures. I initially used a LibreOffice Calc spreadsheet workbook in an attempt to manage all of the medical bills from the different providers. Using a spreadsheet workbook to manage my medical costs worked, but I found it somewhat cumbersome to manage.

I began using GnuCash in 2012 to manage my personal finances. GnuCash is a FOSS (free and open-source software), cross-platform, personal and small office financial management program. I thought GnuCash might be a better alternative to using a spreadsheet workbook for managing my medical costs.

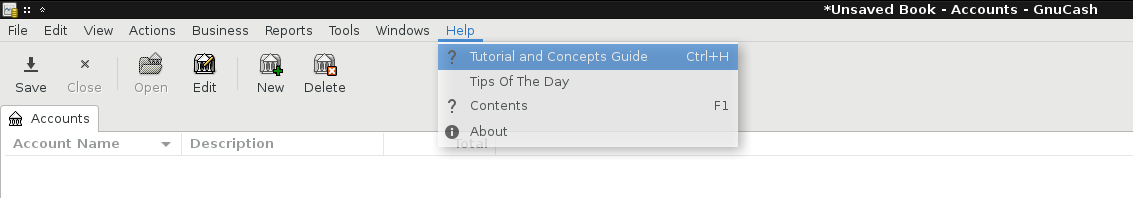

If you are a Linux user, GnuCash should be in your distribution’s software repository. macOS and Windows users can download the program from the GnuCash site. GnuCash comes with a nice tutorial that you may want to review to become better acquainted with how GnuCash works. The tutorial is available under Help in the GnuCash menu bar or by simultaneously depressing the CTRL and H keys on your keyboard.

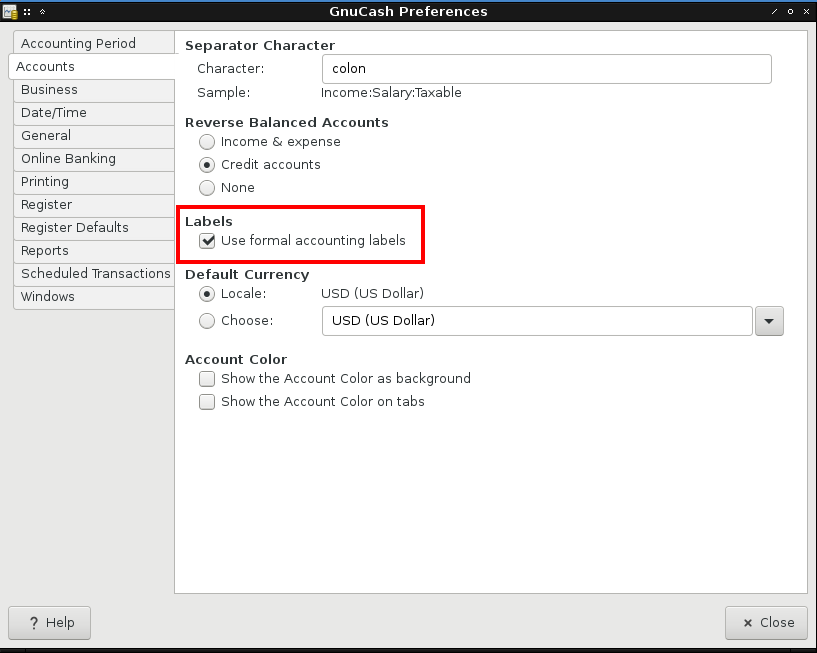

I have an accounting background, so I prefer to use debits and credits (formal accounting labels under GnuCash preferences) in all of my GnuCash databases.

GnuCash default preferences after installation do not have the formal accounting labels option checked. Instead, you’ll see the words Increase and Decrease used in accounts. I will provide screenshots in this tutorial using both sets of terminology for the benefit of everyone.

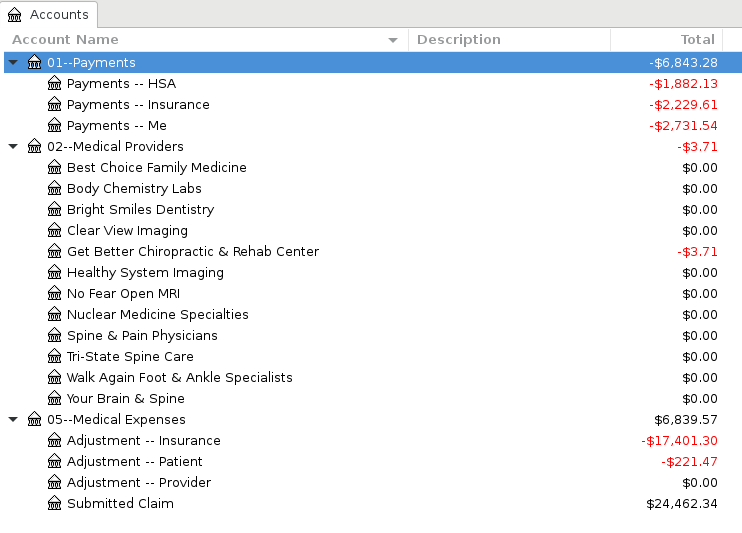

My GnuCash medical costs database is comprised of three account categories: payments (asset), providers (accounts payable/liability), and expenses.

When you visit a doctor’s office, you are either required to make some type of payment, or you wait and make a payment after completion of the insurance claim process. To be able to verify exactly what you owe a health care provider, I find it beneficial to record the actual claim amount submitted by the health care provider.

I will cover two scenarios in this tutorial: no payment at time of service and a partial payment at time of service.

Scenario 1 — No Payment at Time of Service

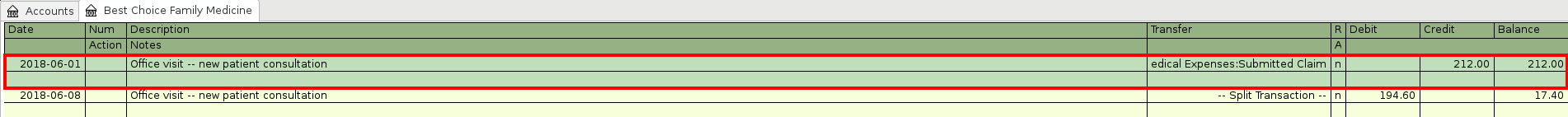

On June 1, 2018, you visit Best Choice Family Medicine for a new patient consultation. Best Choice Family Medicine doesn’t require any kind of advance payment. They wait until the insurance claims process is complete and then bill you for any balance due. Best Choice Family Medicine is an in-network provider under your health insurer, so you only pay what your insurer allows. Late in June, you receive an explanation of benefits statement from your health insurer for the June 01, 2018 new patient consultation with Best Choice Family Medicine.

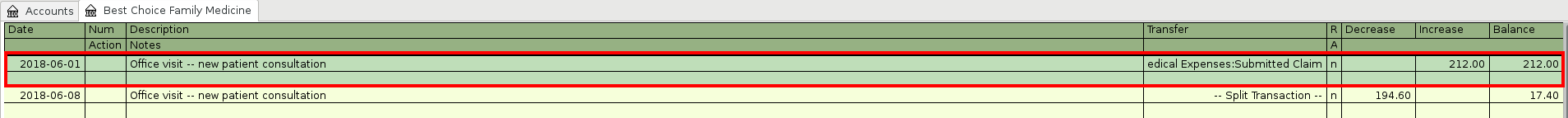

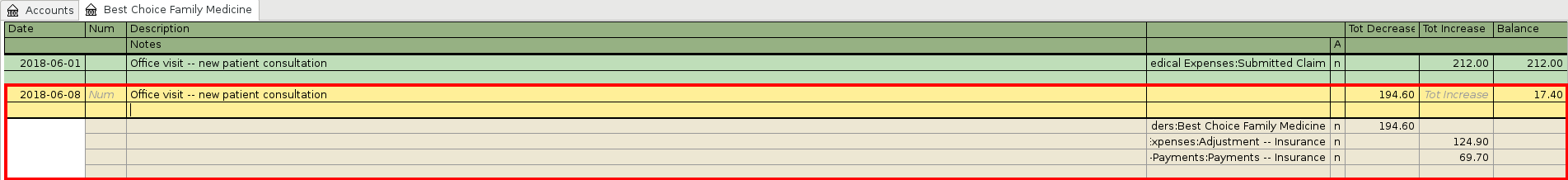

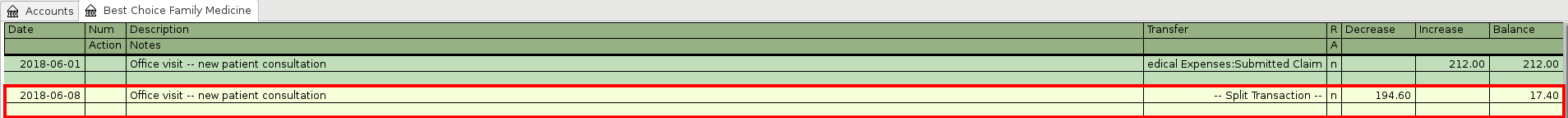

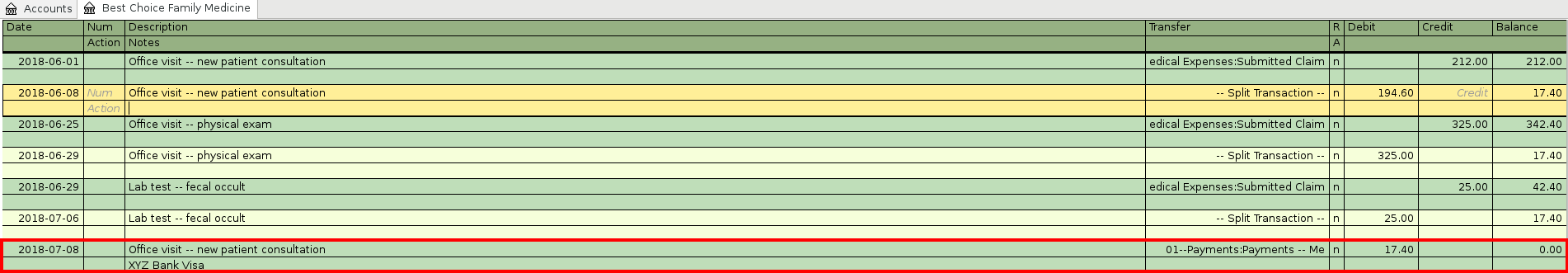

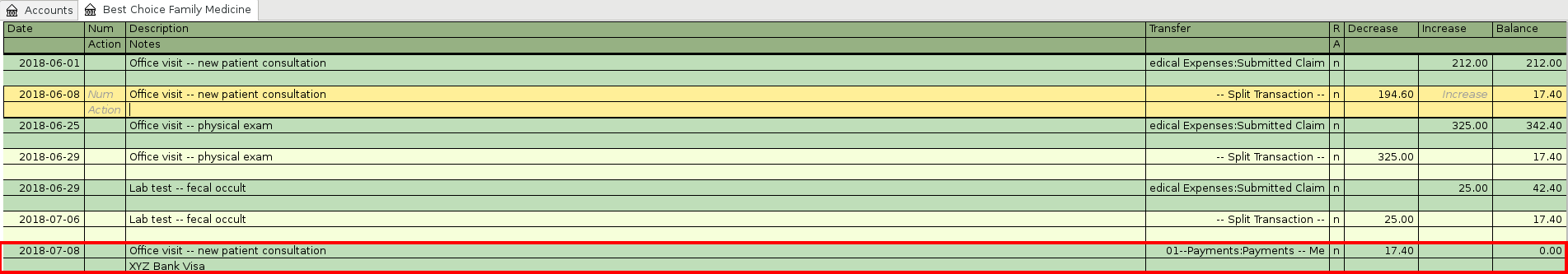

According to the explanation of benefits statement, Best Choice Family Medicine submitted a claim in the amount of $212 for the new patient consultation. Your health insurer only allows $87.10 for the consultation, an adjustment of $124.90. Your health insurer pays Best Choice Family Medicine $69.70 on June 08, 2018, leaving a balance of $17.40 as your responsibility. Making the proper entries in GnuCash should verify the final amount due of $17.40.

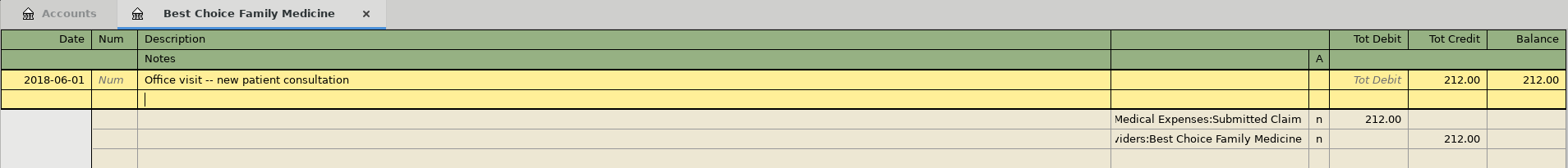

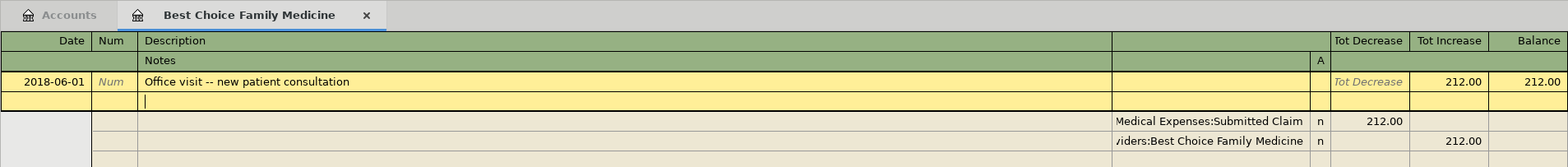

Two entries will be made based on the explanation of benefits statement. First, an entry is made to record the actual claim amount submitted by Best Choice Family Medicine. The entry will be recorded as a credit or increase to the Best Choice Family Medicine account, using an expense account in the Transfer field.

To see exactly how this entry is being recorded by GnuCash, click the Split button in the GnuCash button bar while in a entry line.

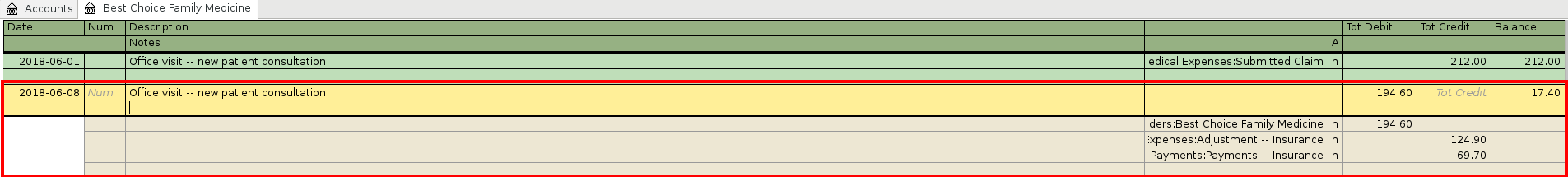

Next, an entry is made to record the adjustment and payment by the health insurer. This entry will be done using what is called a split in GnuCash. To record a split entry, click the Split button in the GnuCash button bar (reference screenshot above) while in a entry line. A debit or decrease of $194.60 will be recorded to the Best Choice Family Medicine account for the total of the insurance adjustment and insurance payment, with a credit or increase of $124.90 to insurance adjustment expense and a credit or increase of $69.70 to insurance payments.

You decide to pay the balance due to Best Choice Family Medicine on July 08, 2018. A debit or decrease in the amount of $17.40 is made to the Best Choice Family Medicine account, using a payment account in the Transfer field.

Scenario 2 — Partial Payment at Time of Service

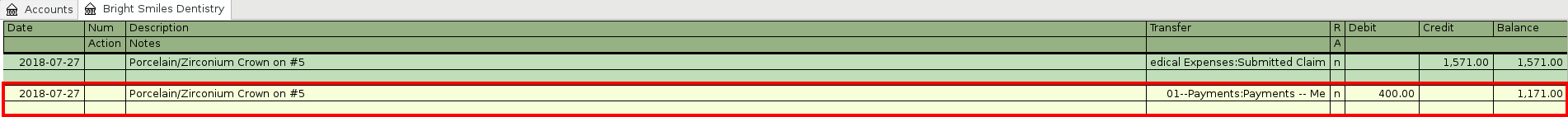

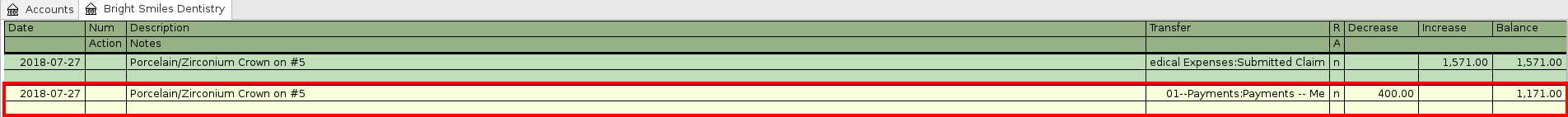

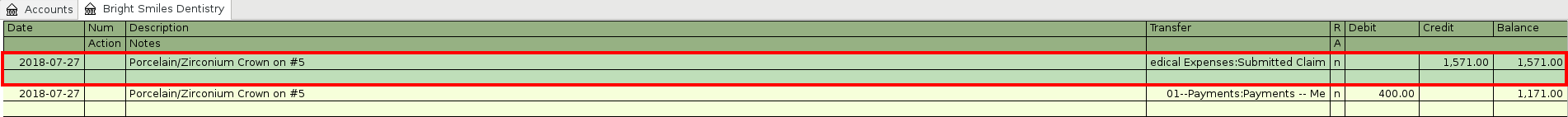

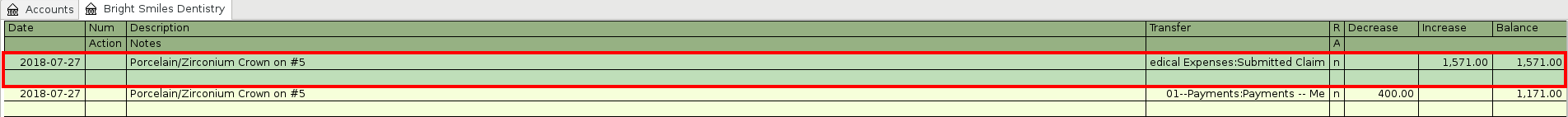

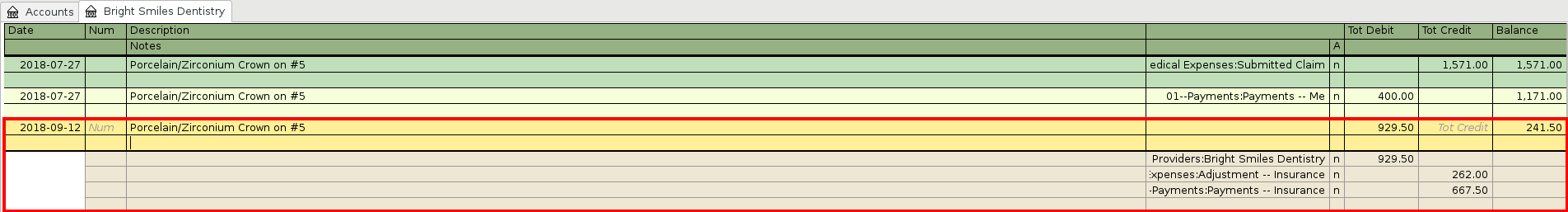

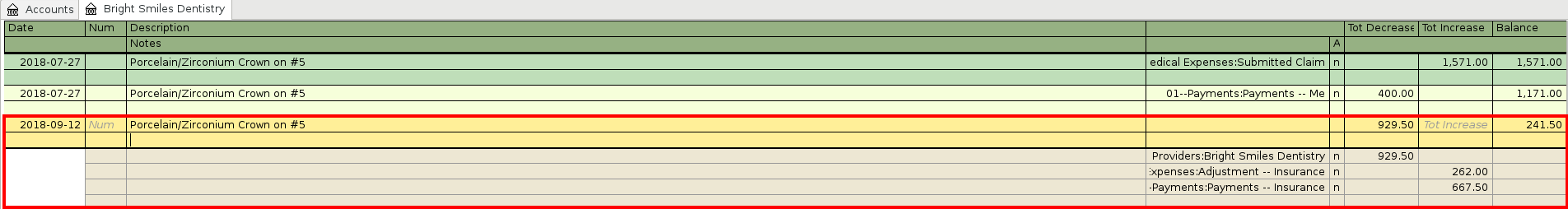

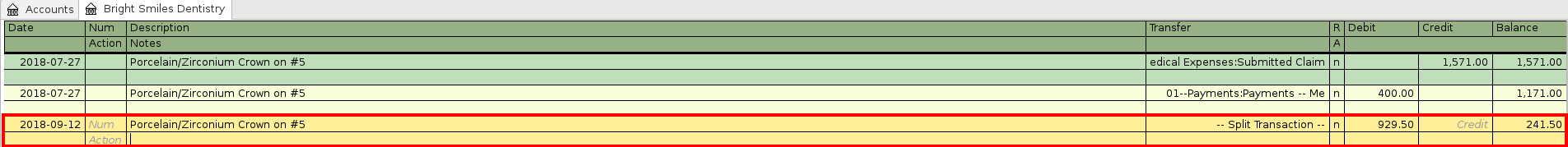

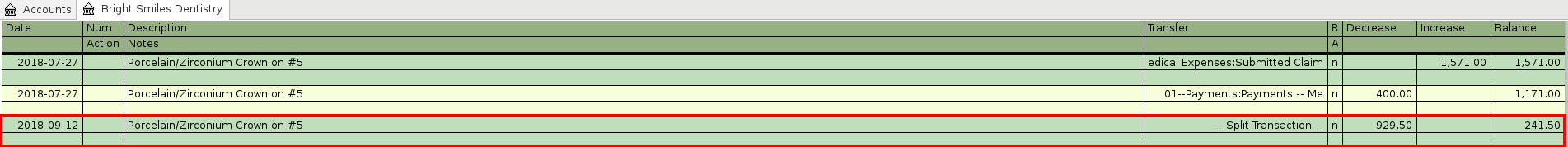

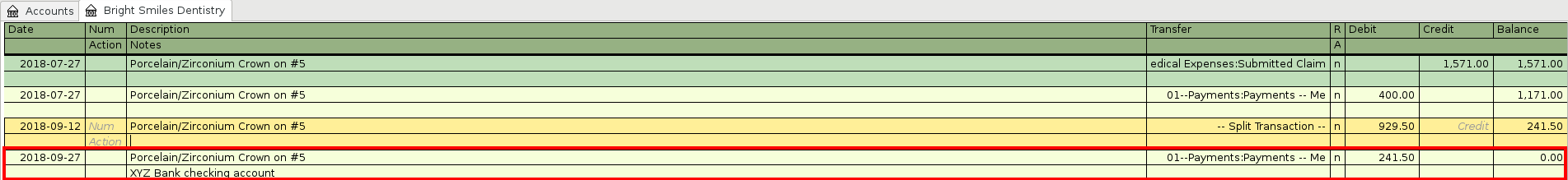

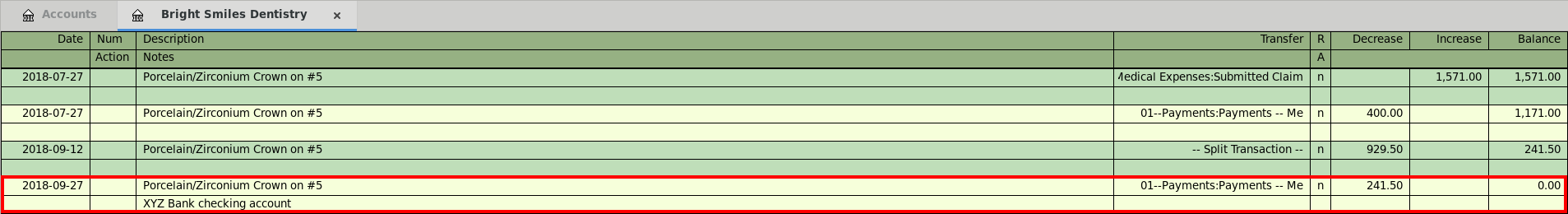

On July 27, 2018, you have the initial preparation for a porcelain/zirconium crown on tooth #5 performed by Bright Smiles Dentistry. Bright Smiles Dentistry requires a partial payment of $400 for the total cost of the procedure at the end of the appointment. A payment to a provider is a decrease in what you will eventually owe them. So you would record a debit or decrease of $400 to the Bright Smiles Dentistry account, using payment account in the Transfer field. Don’t let the entry for $1,571.00 confuse you. That entry will be explained next.

You go back to Bright Smiles Dentistry in August for the final crown placement and Bright Smiles Dentistry then submits a claim to your dental insurer. Bright Smiles Dentistry is a in-network provider under your dental insurer, meaning you only pay what the insurer allows, not what Bright Smiles Dentistry submits in their initial claim or might really charge you if you didn’t have dental insurance.

You receive the explanation of benefits from your dental insurer in mid September 2018. Bright Smiles Dentistry submitted a claim in the amount of $1,571.00, but your insurer allows only $1,309.00, an adjustment of $262.00. Your dental insurance pays $667.50 to Bright Smiles Dentistry on September 12, 2018, leaving a balance of $641.50 as your responsibility. Since you made a partial payment of $400 after your appointment for the initial crown preparation, your final balance owed should be $241.50. Making the proper entries in GnuCash should verify the final amount due of $241.50.

The first entry would be a credit or increase of $1,571.00 to the Bright Smiles Dentistry account to record the actual claim amount submitted.

The second entry will record the insurance adjustment and the amount paid by insurance. Once again, a split will be used to record the entry. The amount of the adjustment and the amount paid by the dental insurer total $929.50. So you would record a debit or decrease of $929.50 to the Bright Smiles Dentistry account and a credit or increase of $262.00 to insurance adjustment expenses and a credit or increase of $667.50 to insurance payments.

On September 27, 2018, you decide to pay the balance due to Bright Smiles Dentistry. A debit or decrease in the amount of $241.50 is made to the Bright Smiles Dentistry account, using a payment account in the Transfer field.

I’ve included a copy of the GnuCash file I used for this tutorial. It can be used as a template for your use. I’ve also provided a GPG signature for the GnuCash file that can be used to verify that the file has not been tampered with. The signature of the GnuCash file should be verified before decompressing it. You will also need the Shared Bits public key and verification software.

I hope this tutorial and the attached GnuCash file will be of help to you in managing your personal medical costs. If you found this post useful, check out my post on managing separate pots of money in GnuCash.

Note: The data used in this tutorial and in the attached GnuCash file are fictitious.

Post header image courtesy of Myriams-Fotos at Pixabay.

2018-015